MULTICAP PORTFOLIO

FLEXIBLE INVESTMENT OFFERING

There are investment opportunities across market capitalisation as companies graduate from one segment to the other, thereby, a Multicap Equity essentially helps in boosting your investment needs, offering the flexibility to switch between small-mid & large caps without any restrictions.

OBJECTIVE

The objective is to invest in equity and equity related instruments to generate capital appreciation over long term. The strategy will help invest across all sectors and market capitalization stocks by adopting a sector and a market cap agnostic approach.

INVESTMENT PRINCIPLE

Ensuring the best of returns for you – is a process & we function based on the proprietory investment model. The model is derived with the help of both qualitative & quantitative means, a conglomeration of our expertise backed by data to ensure conscious investments that help in amplifying returns while managing the portfolio risks in the market. The model helps in guiding to buy ‘great’ businesses at fair value, ‘good’ businesses at a discount or keep you off from ‘bad’ businesses.

FEATURES

Multicap strategy with balance across large cap, midcap and small cap

Benchmark agnostic investment style with bottom-up stock picking- As per the merit of the company in question

Sector agnostic portfolio benefitting from different business models

Focused portfolio of around 25 stocks

FUND PERFORMANCE

| RETURNS | FUND | S&P BSE 500 TRI | ALPHA (BSE 500 TRI) |

|---|---|---|---|

| 1 Month | 8.2% | 4.0% | 4.2% |

| 3 Months | 28.5% | 12.5% | 16.1% |

| 6 Months | 36.4% | 14.8% | 21.6% |

| 1 YEAR | 39.2% | 17.4% | 21.7% |

| 2 YEAR | 13.1% | 13.1% | 0.1% |

| SINCE INCEPTION | 16.7% | 14.6% | 2.1% |

Performance figures are net of all fees and expenses. InCred Portfolio returns are composite returns of all the Portfolios aligned to the investment approach as on April 2023. Returns for individual client may differ depending on time of entry in the Portfolio. Past performance may or may not be sustained in future and should not be used as basis for comparison with other investments. Returns for 1 year or lesser time horizon are absolute returns. Returns have been calculated using Time Weighted Rate of Return method (TWRR) as prescribed by the SEBI.

HEALTHCARE PORTFOLIO

THE PERFECT DOSE OF INVESTMENT SOLUTIONS

India is often addressed as the “Pharmacy of the World” and has a global competitive advantage. The healthcare investment opportunity includes business which areglobal as well as domestic and we at InCred have an expertise in the domain – that’s sure to boost your portfolio’s growth.

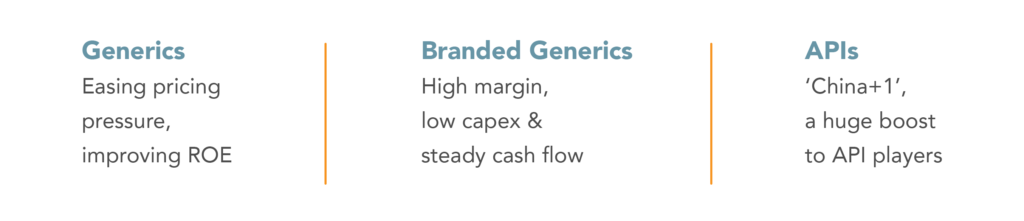

TRENDS OF LAST DECADE

OBJECTIVE

The investment objective is to primarily invest in equity and equity related instruments focused on the healthcare ecosystem in India.

INVESTMENT PRINCIPLE

Maintaining a healthy investment curve in the healthcare market is a series of well-analysed doses of risk taking & returns generated. We function based on the proprietory investment model derived with the help of both qualitative & quantitative means, a thorough use of our expertise backed by data to ensure conscious investments that help maintain a healthy balance of risks & returns. The model helps in buying ‘great’ businesses at fair value, ‘good’ businesses at a discount or keep you off from ‘bad’ businesses, on our investment journey.

FEATURES

Multicap strategy with higher focus towards midcap and small cap

Primarily investing in sectors including pharmaceuticals, hospitals, diagnostic, insurance etc.

Benchmark agnostic bottom-up stock picking

FUND PERFORMANCE

| RETURNS | FUND | S&P BSE 500 TRI | BSE HEALTHCARE INDEX | ALPHA (BSE 500 TRI) | ALPHA (BSE HEALTHCARE INDEX) |

|---|---|---|---|---|---|

| 1 Month | 5.6% | 4.0% | 7.7% | 1.6% | -2.2% |

| 3 Months | 20.6% | 12.5% | 20.8% | 8.1% | -0.2% |

| 6 Months | 24.5% | 14.8% | 24.0% | 9.7% | 0.5% |

| 1 YEAR | 23.4% | 17.4% | 22.2% | 6.0% | 1.2% |

| 2 YEAR | 1.2% | 13.1% | 3.7% | -11.9% | -2.6% |

| SINCE INCEPTION | 10.9% | 14.9% | 10.8% | -4.0% | 0.1% |

Performance figures are net of all fees and expenses. InCred Portfolio returns are composite returns of all the Portfolios aligned to the investment approach as on April 2023. Returns for individual client may differ depending on time of entry in the Portfolio. Past performance may or may not be sustained in future and should not be used as basis for comparison with other investments. Returns for 1 year or lesser time horizon are absolute returns. Returns have been calculated using Time Weighted Rate of Return method (TWRR) as prescribed by the SEBI.